How to Build a Diversified Investment Portfolio in 2025

Want to grow wealth and reduce investment risk in 2025? This guide shows you how to build a diversified portfolio using stocks, mutual funds, gold, insurance, and more.

Introduction: Why Diversification Is Key to Financial Success

In an uncertain and fast-changing economic environment like 2025, diversification is no longer a luxury—it’s a necessity. The old advice of “don’t put all your eggs in one basket” is especially relevant for investors who want to grow wealth while minimizing risk.

Whether you're a beginner or someone looking to rebalance your existing portfolio, this guide will walk you through:

What a diversified investment portfolio is

Why diversification matters

Key asset classes to consider in 2025

How to allocate your funds smartly

Common mistakes and how to avoid them

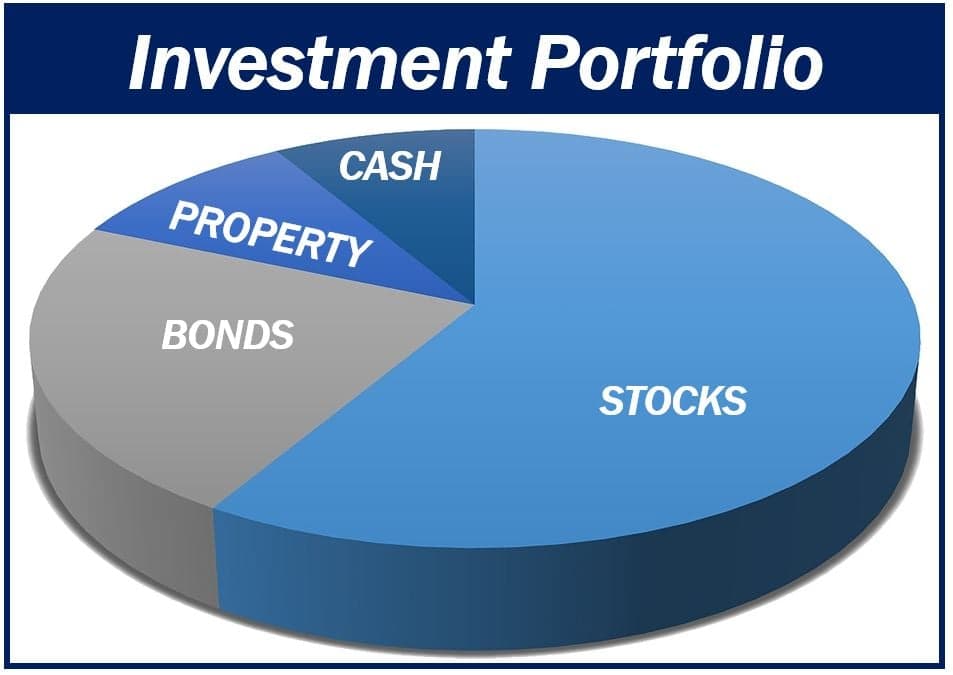

1. What Is a Diversified Investment Portfolio?

A diversified portfolio spreads your investment capital across different asset classes, industries, and geographies to reduce risk and volatility.

Instead of investing only in NEPSE stocks or only in real estate, a diversified investor might hold:

Stocks for growth

Mutual funds for passive income

Gold for inflation hedge

Fixed deposits for capital protection

Insurance for risk management

Real estate for long-term wealth preservation

2. Why Diversification Matters in 2025

The global and local economic landscape is more unpredictable than ever:

Rising interest rates and inflation

Geopolitical tensions

Market volatility (e.g., NEPSE fluctuations, gold price surges)

Tech-driven asset classes like crypto emerging

NRB policies shifting quarterly

Diversification helps you:

✅ Protect your capital

✅ Reduce risk

✅ Improve returns over time

✅ Stay invested longer without panic

3. Key Asset Classes for Diversification in 2025

Let’s break down the essential investment options for building a balanced portfolio in 2025:

🟢 A. Stocks (NEPSE & International)

Provide long-term capital growth

Suited for risk-tolerant investors

Include sectors like banking, insurance, hydropower, manufacturing

Tips:

Invest in blue-chip stocks (e.g., NABIL, NLIC)

Use MeroShare and TMS to manage investments

Consider sector rotation for smart allocation

🟢 B. Mutual Funds

Ideal for passive investors

Professionally managed, diversified by default

Options: Open-ended funds, closed-end funds (e.g., NIBSF2, NESDO MF)

Tips:

Start with monthly SIPs

Use NAV tracking and dividend history for fund selection

Good for investors with limited time or knowledge

🟢 C. Gold and Silver

Hedge against inflation and currency devaluation

Popular in Nepal due to cultural value

Tips:

Allocate 5–10% of your portfolio in gold

Use physical gold or ETFs (if available in future)

Avoid overexposure during price spikes

🟢 D. Fixed Deposits & Bonds

Provide guaranteed returns

Useful for capital preservation and emergency funds

Tips:

Use bank FDs for 6–12 months at 7–9% return

Look into government bonds (NRB Development Bonds)

Match deposit duration with future needs

🟢 E. Life Insurance with Investment Benefits

Combine risk protection with long-term returns

Endowment or ULIP products can act as low-risk wealth builders

Tips:

Use insurance to cover liabilities (loan, family support)

Avoid using insurance only for investment

Check claim ratio, bonuses, and lock-in period

🟢 F. Real Estate

Tangible, long-term wealth protection

Rental income or land appreciation

Tips:

Choose land in growing urban/rural centers

Diversify across geography (Kathmandu, Pokhara, Hetauda, etc.)

Avoid locking all liquidity in real estate

🟢 G. Emerging Assets (Optional)

Cryptocurrency (very high risk)

Startup crowdfunding

Foreign equity via global apps (if legally enabled)

Tips:

Limit to <5% of your portfolio

Only invest what you can afford to lose

Stay updated on NRB’s stance

4. Sample Portfolio Models (2025)

Your ideal allocation depends on age, income, risk appetite, and goals. Here are sample models:

A. Conservative Portfolio (Low Risk)

Asset Class | Allocation |

|---|---|

Fixed Deposits | 35% |

Mutual Funds | 20% |

Life Insurance | 15% |

Gold/Silver | 10% |

Stocks (NEPSE) | 10% |

Real Estate | 10% |

B. Balanced Portfolio (Moderate Risk)

Asset Class | Allocation |

|---|---|

Stocks | 30% |

Mutual Funds | 25% |

Fixed Deposits | 15% |

Gold | 10% |

Insurance | 10% |

Real Estate | 10% |

C. Growth Portfolio (Aggressive)

Asset Class | Allocation |

|---|---|

Stocks | 40% |

Mutual Funds | 25% |

Emerging Assets | 10% |

Gold | 10% |

Fixed Deposits | 5% |

Real Estate | 10% |

5. How to Start: Step-by-Step Portfolio Building

✅ Step 1: Set Your Goals

Buying a house? Child’s education? Retirement?

✅ Step 2: Know Your Risk Tolerance

Conservative or aggressive? Take a quiz or consult an advisor.

✅ Step 3: Allocate Assets Accordingly

Use one of the models above, customize as needed.

✅ Step 4: Automate and Track

Use Excel or mobile apps to track performance

Review every 3–6 months

✅ Step 5: Rebalance Periodically

Sell outperformers, buy laggards to maintain your target ratio

6. Common Mistakes in Portfolio Building

❌ Investing everything in IPOs or NEPSE stocks

❌ No emergency fund

❌ Chasing returns blindly (crypto, rumors)

❌ Overexposure to illiquid real estate

❌ Ignoring inflation and tax impacts

❌ Failing to review and rebalance

7. Portfolio Tips for Nepali Investors (2025 Edition)

Use NEPSE’s 52-week high/low and dividend reports for stock decisions

Don’t apply for every IPO—check fundamentals

Track inflation and interest rates to adjust allocation

Don’t skip life and health insurance

Avoid loans for investing in risky assets

Conclusion: Balanced Growth is the Best Strategy

A well-diversified portfolio balances:

✅ Risk and return

✅ Growth and safety

✅ Short-term liquidity and long-term goals

“Don’t time the market—allocate your assets and give them time to grow.”

In 2025, financial stability comes not from betting on one asset—but from owning a thoughtful mix of many. Start small, stay disciplined, and let diversification do its magic.